The Texas title loan verification process requires borrowers to prove income, identity, and vehicle ownership through documentation. Lenders assess loan amounts based on vehicle equity, with appraisals and background checks ensuring fairness and security. Challenges like inaccurate records or poor credit history may delay funding, so maintaining accurate information and exploring debt solutions is crucial for favorable Texas title loan terms.

In the competitive landscape of Texas, understanding the intricate details of a title loan verification process is paramount. This comprehensive guide breaks down the key components of what happens during this critical phase, from meeting initial Texas title loan requirements to navigating the step-by-step verification process. Furthermore, it sheds light on common issues and offers practical solutions, ensuring you’re equipped with the knowledge to successfully navigate this financial instrument.

- Understanding Texas Title Loan Requirements

- The Step-by-Step Verification Process

- Common Issues and How to Address Them

Understanding Texas Title Loan Requirements

Before delving into the Texas title loan verification process, it’s crucial to grasp the requirements set by the state. In Texas, borrowers seeking a title loan must meet specific criteria to ensure eligibility. Lenders will typically require proof of income, a valid driver’s license or state ID, and a clear vehicle title showing the borrower as the owner. The key aspect is the vehicle equity, where the lender uses the value of your vehicle as collateral for the loan. This process ensures that both parties are protected, providing quick funding while mitigating risks.

Understanding these requirements is essential to navigate the Texas title loan verification process smoothly. Borrowers should provide accurate and complete documentation to avoid delays or complications. Once the lender verifies the documents, they can assess the loan amount based on the vehicle’s equity, making it a swift and efficient transaction for those in need of immediate financial assistance.

The Step-by-Step Verification Process

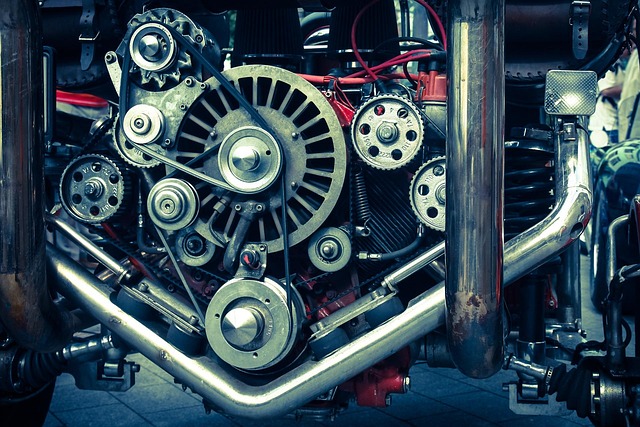

The Texas title loan verification process is a meticulous procedure designed to ensure fairness and security for both lenders and borrowers. It begins with the borrower submitting an application, providing essential information about their vehicle and financial standing. This initial step involves verifying the borrower’s identity, checking their credit history, and assessing their ability to repay the loan. Once the application is approved, the lender will schedule a visit to inspect the vehicle, ensuring it matches the description provided and is in satisfactory condition.

During this inspection, a professional appraiser assesses the car’s value, year, make, model, and overall condition. They also verify any existing titles or liens on the vehicle. After the appraisal, the lender conducts a thorough background check, cross-referencing the borrower’s data with multiple databases to confirm their employment, income, and creditworthiness. This step is crucial for approving bad credit loans while ensuring responsible lending practices. The entire process aims to facilitate same-day funding for secured loans, providing borrowers with quick access to funds while maintaining stringent verification standards.

Common Issues and How to Address Them

During the Texas title loan verification process, common issues often arise that can delay or even threaten the approval of your loan request. One prevalent problem is inaccurate or incomplete documentation. To address this, maintain meticulous records and ensure all required documents are up-to-date and correctly filled out. Another frequent hurdle involves outstanding debts or poor credit history. While these factors may impact interest rates, many lenders in Texas offer financial assistance programs designed to help borrowers with debt consolidation options, allowing them to manage their loans more effectively.

Additionally, understanding and being aware of the varying interest rates is crucial. Lenders in Texas are required to disclose all fees and charges, so transparency is key. Comparisons between different loan offers can help borrowers secure the most favorable terms. The verification process may also uncover issues related to the vehicle’s title or history, but these concerns can often be resolved through proper documentation and communication with the lender.

The Texas title loan verification process is a meticulous step-by-step procedure designed to ensure consumer protection. By understanding both the requirements and the verification process, borrowers can navigate this regulated lending environment with confidence. Addressing common issues proactively enhances the overall experience, making it crucial for folks considering a Texas title loan to be informed and prepared throughout the tapestry of this financial decision.